Hello Friends,

What does a sermon, a broken heart and a Facebook ad all have in common?

About 6 months ago I was invited to attend a church service with a friend. The key scripture shared was

The pastor invited us to ask ourselves....what breaks my heart? I had trouble thinking of something concrete in that moment, so I diligently took notes instead.

"God will break your heart. Pay attention to that emotion and God will prompt you to pray. Let your tears be the trigger to pray. He will move you into action. He will ask, 'What will you do about it?' Look at your workplace as a place to make a difference. When burdened, don't act right away. Pray."

I left that service asking myself, 'what breaks my heart?' and remember praying about this question the next day in a quiet moment with God.

A few months later, I found myself in tears driving home from a couple of consultations. I'm not one to cry in front of clients, but later in reflection, I'll let their situations filter into my heart and my spirit is moved.

Through my work, I've realized that some people desperately need and are ready for organizing but for various reasons cannot get their homes decluttered on their own and feel they cannot afford to hire an organizer for help.

It breaks my heart.

Ah God, you are so good to answer my prayer I thought to myself, feeling sad, but what do you expect me to do about it?

Days passed.

In looking for something else, I randomly came across the sermon notes and marveled at how something was unfolding. I prayed.

And then as so often happens, a Facebook ad popped up on my newsfeed.

How do they know?

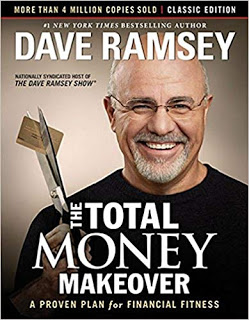

This ad advertised the opportunity to become a

Ramsey Solutions Master Financial Coach

. Huh? I wondered if this opportunity was for me. I signed up for a webinar and then was chosen to participate in another to ask more questions. I found that their approach matched up with my core values - always a sign of a good thing for me.

You see, many years ago

helped our family get out of debt when I read one of his books,

.

We were so far in debt that I never added it all up! We owed the IRS, property taxes, an SBA loan from earthquake damage to our home, (

living in LA there are earthquakes!

), a mortgage, medical debt, student loan debt, credit card debt, and debt to creditors from a business, it went on and on. We were drowning and to top it off our home was for sale, and the three of us (

we had a toddler too

) were living with my dad, having relocated to another state so my husband,

at the time,

could start working his way up from the bottom of a new career field.

Fortunately, my dad came alongside me at this time,

because there were no financial coaches

, and taught me how to budget. Then I put the principles of the book in place using the

Dave Ramsey recommends. In the span of 5 years, we'd sold the house, paid off all the debt and saved up enough to put a down payment on another home as well as had another baby. We were debt free.

Since that time, I've had an interest in finances but never followed through, leaving it to others to decide my financial fate and continuing to make less than perfect financial decisions myself.

I decided it was time to learn more on behalf of my clients and for myself. I took the class and as of last week, I have earned my designation as a...

Ramsey Solutions Master Financial Coach.

Cue the music!

As a coach, I seek to understand your situation, provide information and give hope.

I can walk you through budgeting, give you a process to get out of debt, coach you how to deal with collections, avoid bankruptcy, help you work out payment plans, develop understanding of your student loan debt, point you to investing, go through the various types of insurance, put a plan together to save for retirement, and give you information about estate planning.

It dovetails nicely with the coaching work I already do with people for organizing, such as getting their paperwork in order, setting up a filing system, managing bill payment, working with *

and so on.

Wouldn't it be something if we all lived within our means, had robust savings accounts and were able to give freely to the causes we are passionate about?

I'm here to help; one person at a time.

*I am a referral partner with Quickbooks and do receive a small commission if you sign up for Quickbooks Self Employed through the link.

Live locally? Check out

Financial Peace University at Journey Church

starting on September 24.

What is your biggest hurdle to becoming debt free?

Have you ever used a coach for anything before?